E Commerce Etf 2020

The ETF has 236 million in assets under management and focuses on the growth of e-commerce rather than instore sales. When choosing a e-commerce ETF one should consider several other factors in addition to the methodology of the underlying index and performance of an ETF.

Livestreaming Set To Unlock Greater E Commerce Spending In China Seeking Alpha

The underlying Solactive E-commerce Index provides exposure to exchange-listed companies that looks to benefit from the growing adoption of e-commerce as a distribution model.

E commerce etf 2020. The Global X E-commerce ETF EBIZ Up 741. It charges 50 bps in fees. Global X Emerging Markets Internet E-commerce ETF.

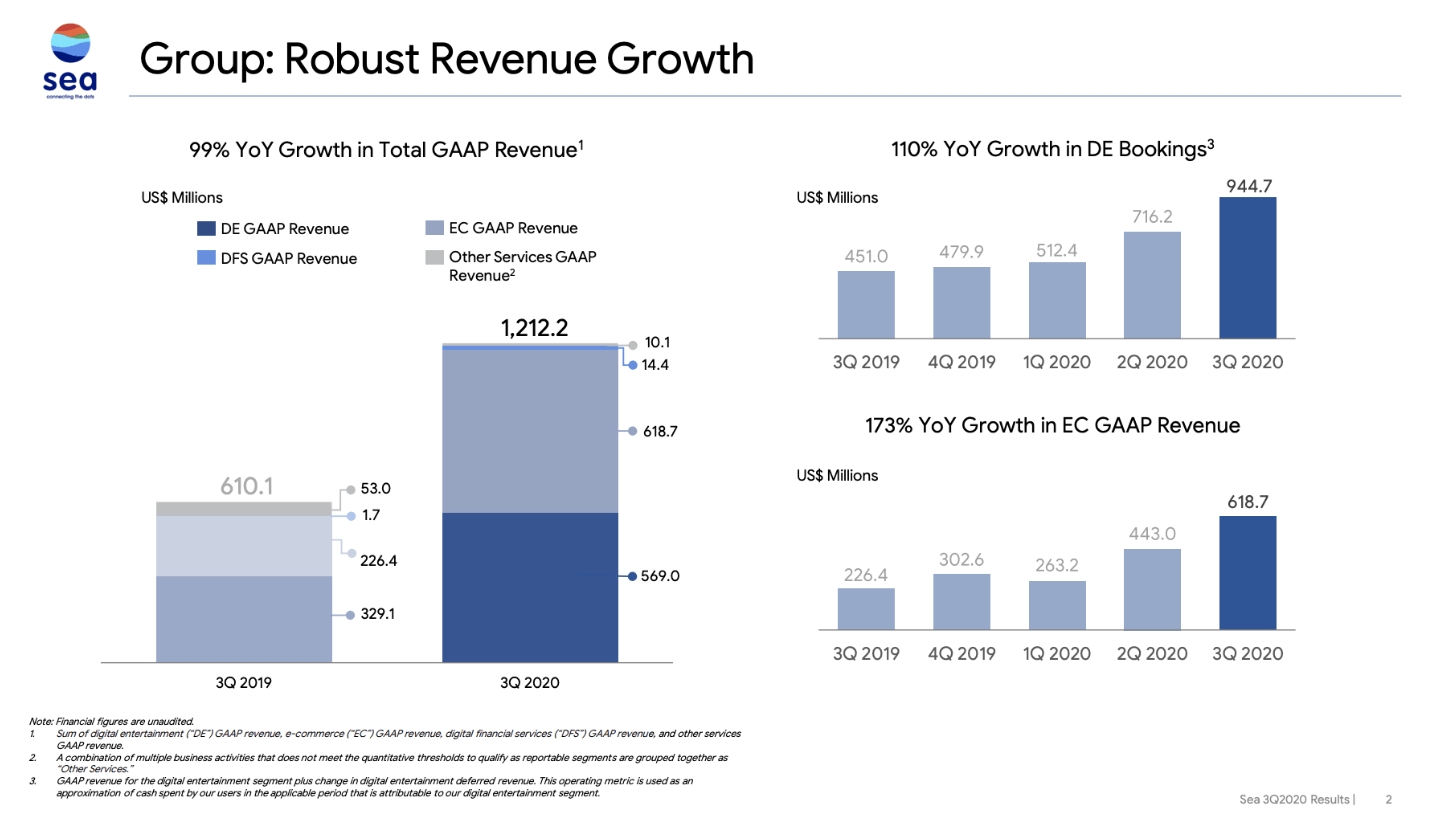

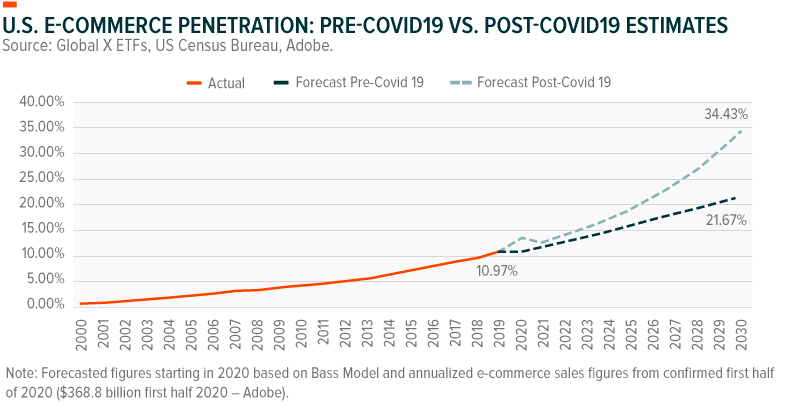

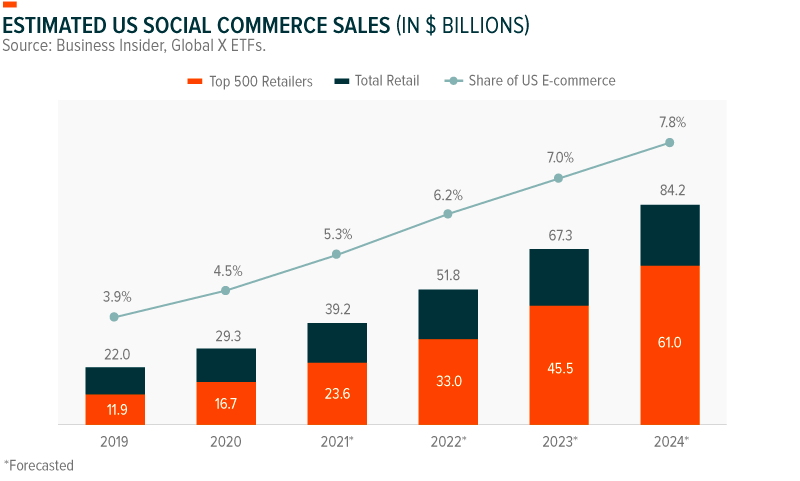

Internet and e-commerce stocks have surged in the COVID-induced 2020 as it has less to do with human contact. For example when the pandemic hit in 2020 online shopping from home accelerated and sales grew by over 40 year over year in the second quarter of the year. It charges 86 bps in fees read.

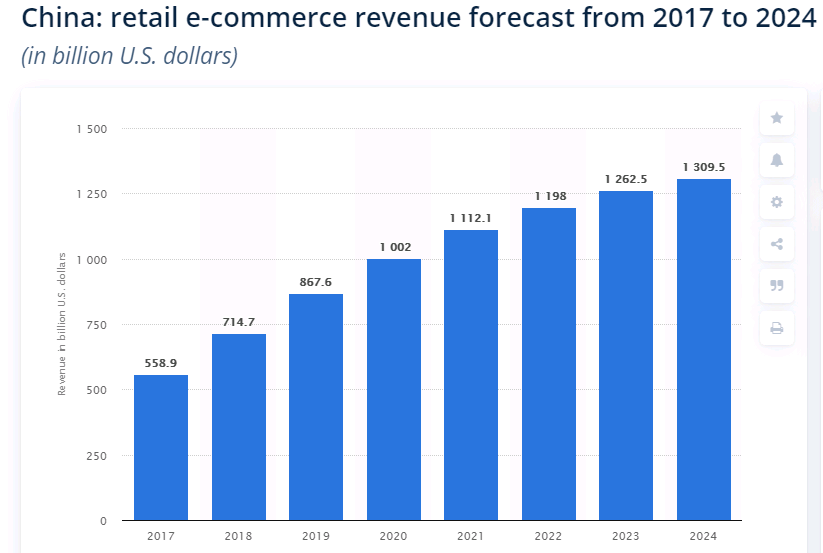

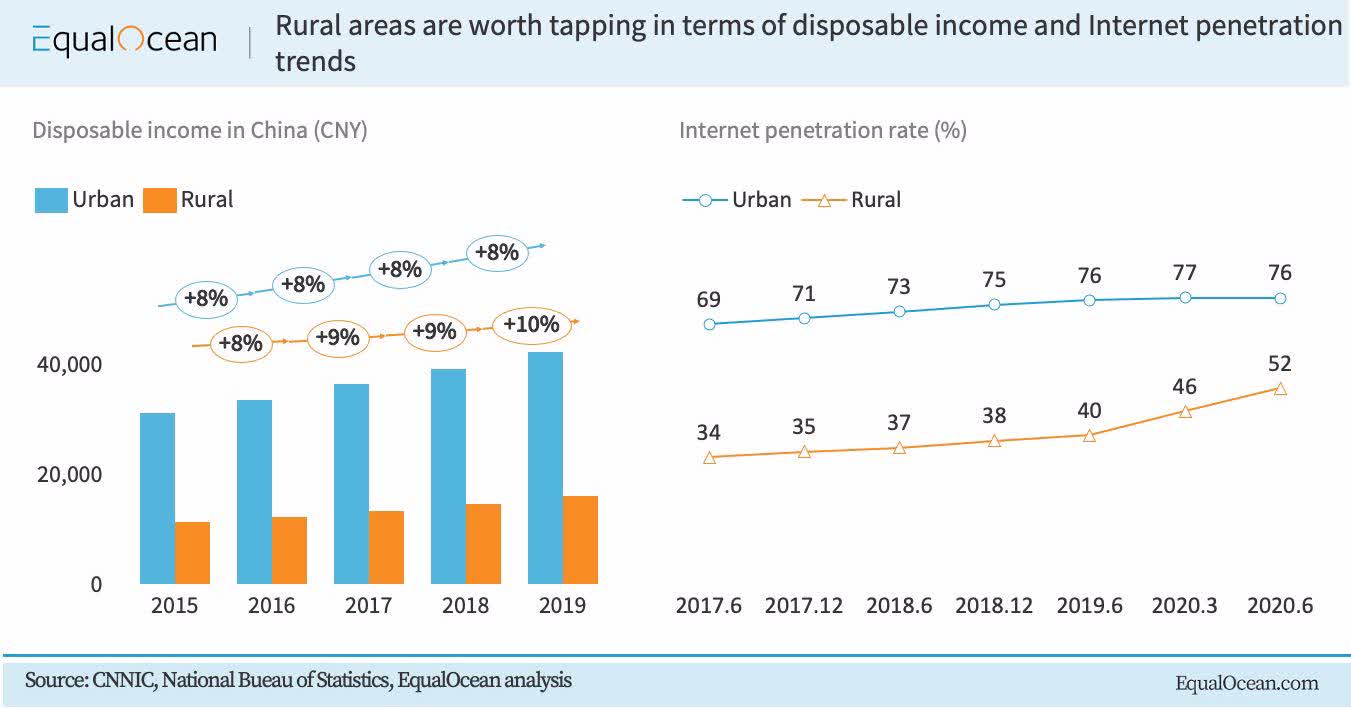

1 Global Tailwinds E-commerce is a global theme poised to benefit as expanding broadband and mobile internet penetration coincide with a rising middle class in developing markets. Buy E-Commerce ETFs to Tap Safe Early Holiday Shopping. A New ETF to Play Rapid Emergence of Emerging Market Internet.

The proof is in the pudding as many dedicated e-commerce exchange traded funds regardless of Amazon weight are beating the more traditional SPDR SP Retail ETF. SPDR Bloomberg SASB Corporate Bond ESG Select ETF. The Global X E-commerce ETF EBIZ Up 741.

It shows a reduction in portfolio value from its maximum due to a series of losing trades. The Global X E-commerce ETF EBIZ Up 741. Cyber Monday 2020 turned out the biggest digital sales day in history in the United States.

EBIZ - Global X E-commerce ETF. It charges 50 bps in fees. An investment of 1000 since October 2020 now would be worth 111514 with a total return of 1151 1151 annualized.

The Global X E-commerce ETF EBIZ Up 741. It took 34 trading. E-Commerce ETFs in comparison.

For the last four years e-commerce growth has averaged between 13 to 17 increase and last year it was up 147. For better comparison you will find a list of all e-commerce ETFs with details on size cost age income domicile and replication method ranked by fund size. Capital growth returns stats are calculated assuming a reinvestment of dividends.

Dividend Yield is calculated only for a portion of the year. Global X E-Commerce ETF EBIZ The Global X E-Commerce ETF NASDAQ. One online retail ETF Amplify has seen triple-digit.

EWEB seeks to invest in Emerging Market EM internet and e-commerce. Internet and e-commerce stocks have surged in the COVID-induced 2020 as it has less to do with human contact. The underlying Solactive E-commerce Index provides exposure to exchange-listed companies that looks to benefit from the growing adoption of e-commerce as a distribution model.

The underlying Solactive E-commerce Index provides exposure to exchange-listed companies that looks to benefit from the growing adoption of e-commerce as a distribution model. E-commerce exchange-traded funds ETFs give you exposure to a wide range of tech-savvy companies in a variety of industries. A maximum drawdown is an indicator of risk.

Swipe left to see all data. January 2020 - October 2021. See if e-commerce ETFs are right for you.

On the other hand market research firm Forrester expected online retail jumping 185 this year and attaining 202 overall penetration in North America read. EBIZ is another notable idea in the e-commerce ETF fray and it is a departure from the aforementioned IBUY as it. It charges 50 bps in fees.

Launched in 2018 the Global X E-Commerce ETF tracks the Solactive E-commerce Index which focuses on companies positioned to benefit from the increased adoption of e-commerce. The most recent Dividend Yields of Global X E-commerce ETF EBIZ ETF are represented below. If you are interested in getting periodic income please refer to the Global X E-commerce ETF EBIZ ETF.

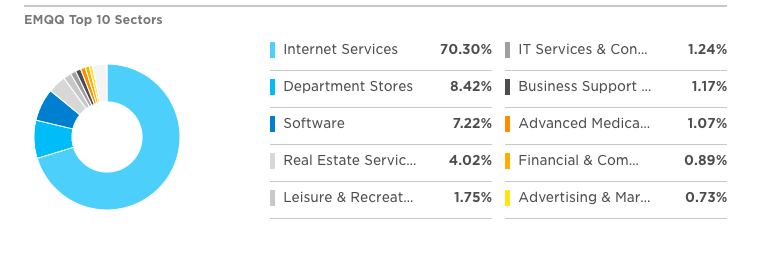

Investors poured 61120 million into EMQQ over the course of 2020 as emerging-market internet and e-commerce stocks led a recovery after the shock of Covid-19 hit markets. A New ETF to Play Rapid Emergence of Emerging Market Internet. Ad Find Index Exchange Traded Funds.

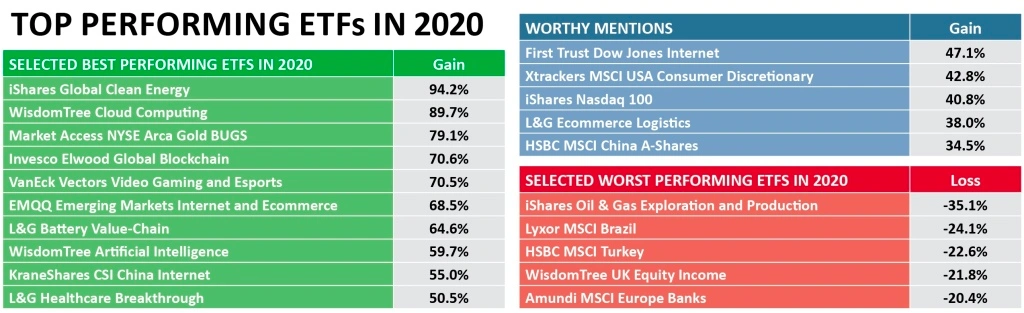

Top-Performing E-Commerce ETFs Stocks of 2020. On November 11th 2020 we introduced the Global X Emerging Markets Internet E-commerce ETF NASDAQ. A couple of e-commerce ETFs that target online portals have done well and taken advantage of pandemic-accelerated online shopping activity.

April 27 2020 755 am. Even by the. Ad Find Index Exchange Traded Funds.

The table below shows the maximum drawdowns of the Global X E-commerce ETF. Despite years of strong growth E-commerce still represented less than one-fifth of global retail sales in 2020 highlighting substantial room for further adoption. Goldman Sachs Innovate Equity ETF.

It charges 86 bps in fees read. The maximum drawdown since January 2010 for the Global X E-commerce ETF is 3271 recorded on Mar 18 2020. Against this backdrop below we highlight a few e-Commerce ETFs and.

2 E Commerce Stocks Poised For A Bull Run The Motley Fool

Pinduoduo Poised To Win Next Battle In China S E Commerce War Nasdaq Pdd Seeking Alpha

E Commerce Entering The Next Wave Of Growth Seeking Alpha

The Year S Best Performing Em Etf Isn T Holding Back Etf Strategy Etf Strategy

Emerging Markets Internet E Commerce Etf Emqq Growth Is Abroad Seeking Alpha

E Commerce Entering The Next Wave Of Growth Nasdaq

6 E Commerce Stocks To Gain As Coronavirus Boosts Online Orders

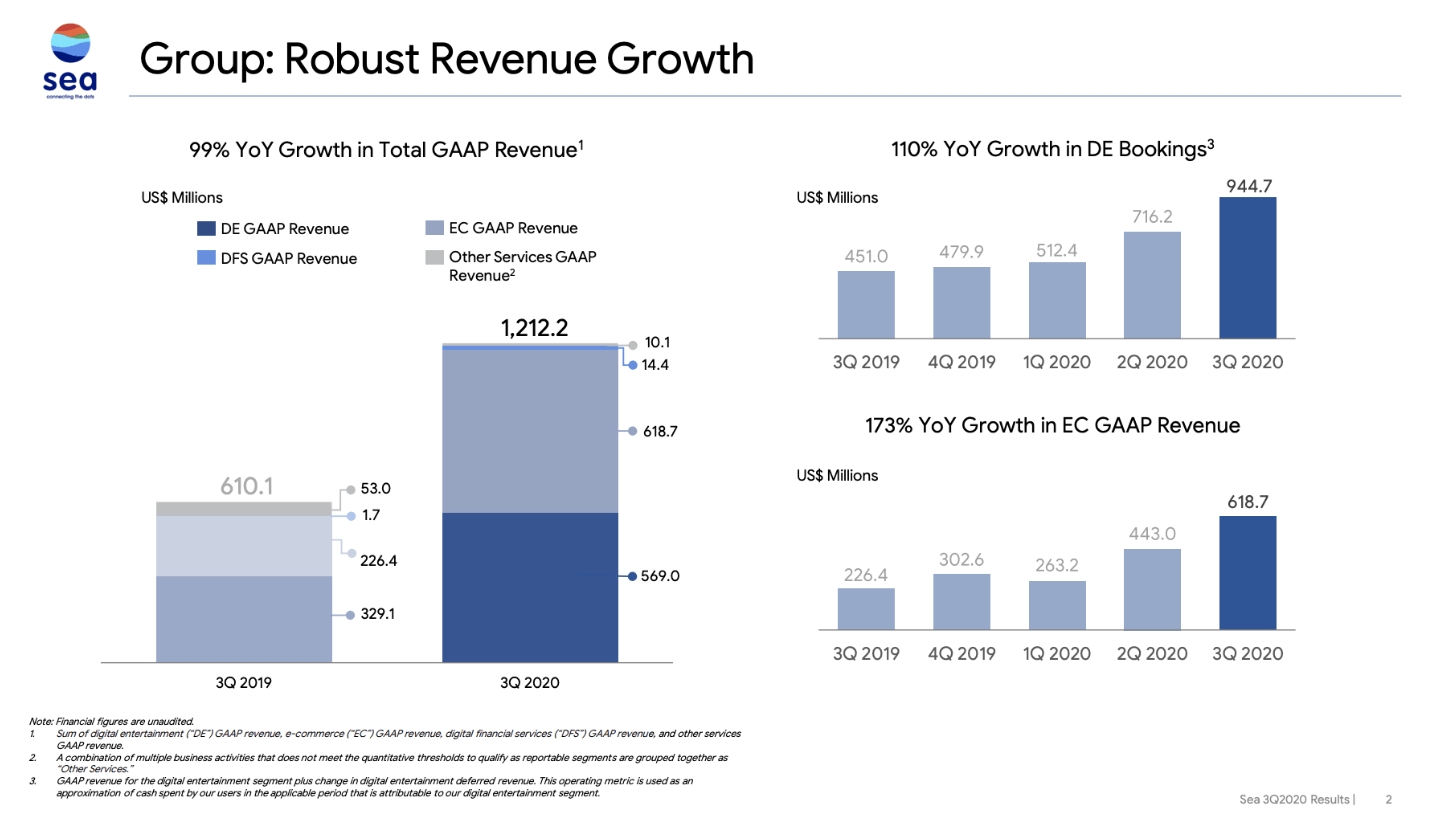

Shopee A Perspective From Indonesia Nyse Se Seeking Alpha

E Commerce Entering The Next Wave Of Growth Nasdaq

Thematic Products Top The Etf Charts In 2020 Shares Magazine

E Commerce Entering The Next Wave Of Growth Gxeu

L G Ecommerce Logistics Ucits Etf Etf Ie00bf0m6n54

Forget Ebay Shopify Is A Better Growth Stock The Motley Fool

E Commerce Entering The Next Wave Of Growth Nasdaq

Posting Komentar untuk "E Commerce Etf 2020"